Khud Mukhtar Program 2025

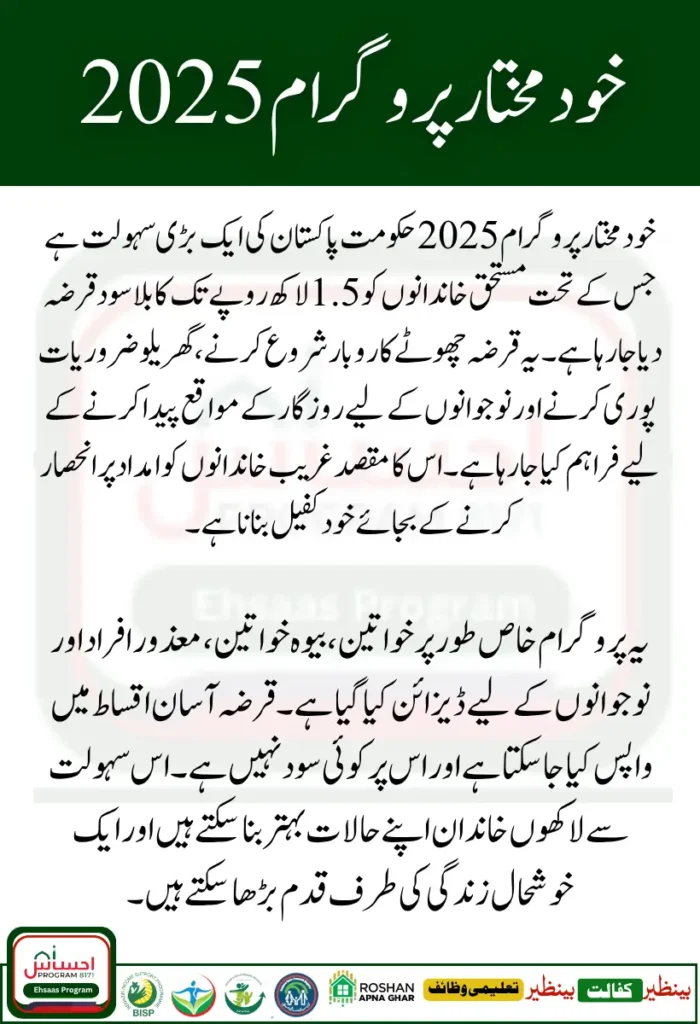

Khud Mukhtar Program 2025 In today’s Pakistan, where inflation is at its peak and jobs are limited, many families face difficulties in managing their expenses. Small business owners and daily wage earners especially struggle to arrange money for investment or even basic needs. To solve this problem, the government has introduced the Khud Mukhtar Program 2025 Get Loan up to 1.5 Lakh.

The main aim of this program is to give financial independence to poor and lower-middle-class families. Instead of only giving cash aid, the government is now providing interest-free loans so that people can start their own small businesses, buy tools, or manage their household needs with dignity. This is not just financial help it is a way to make people self-reliant.

You Can Also Read : BISP 8171 Payment 2025 Check

What is Khud Mukhtar Program 2025?

The Khud Mukhtar Program 2025 is part of the government’s social protection and poverty reduction strategy. Unlike regular aid programs like BISP, this program focuses on giving loans instead of free cash. The idea is simple:

- Provide interest-free loans up to 1.5 lakh rupees.

- Help families start small-scale businesses.

- Encourage people to become self-sufficient instead of depending on aid.

- Promote dignity, confidence, and financial stability.

This loan facility will be provided under the supervision of BISP offices, microfinance banks, and partner organizations.

Khud Mukhtar Program 2025 Get Loan up to 1.5 Lakh Key Features

According to the latest update, here are the main features of the program:

- Loan amount ranges between 50,000 to 150,000 rupees.

- Loans are interest-free (no extra charges).

- Installments can be paid monthly or quarterly.

- Special preference is given to women, widows, and disabled persons.

- Youth looking to start a small business can also apply.

- Loan disbursement will be through banks and designated offices.

You Can Also Read : 8171 New Update Benazir Kafaalat October Installment Released

Who Can Apply for Khud Mukhtar Program 2025 Loan?

Eligibility criteria is simple and designed for poor families. You can apply if:

- You are already registered in BISP database.

- Your poverty score is below the required limit (verified by NADRA records).

- You are a woman head of household, widow, or disabled citizen.

- You belong to a low-income family with no stable source of income.

- You are a youth planning to start a small business (like shop, tailoring, livestock, or services).

Step by Step Process to Apply for Loan in 2025

If you want to benefit from the Khud Mukhtar Program 2025 Get Loan up to 1.5 Lakh, follow these steps:

- Visit your nearest BISP tehsil office or Khud Mukhtar program counter.

- Fill out the loan application form with correct details.

- Attach copies of your CNIC and family details.

- Provide your business plan or purpose of loan (simple explanation is enough).

- Complete biometric verification at the office.

- Wait for verification of your documents and poverty score.

- Once approved, you will receive an SMS notification.

- Collect your loan from the designated bank branch or office.

Documents Required for Khud Mukhtar Loan 2025

To apply successfully, you need:

- Original CNIC and photocopy.

- Proof of income or poverty status (if available).

- Mobile number registered on your CNIC.

- Two passport-size photographs.

- Business idea or purpose of loan.

- In case of widows, husband’s death certificate.

- For disabled persons, disability certificate.

You Can Also Read ; 41,000 Beneficiaries Announced in Govt E-Bike Scheme 2025

Table: Loan Details of Khud Mukhtar Program 2025

| Loan Type | Loan Amount (PKR) | Interest Rate | Repayment Method | Priority Beneficiaries |

| Small Business Loan | 50,000 – 150,000 | 0% (Interest-Free) | Monthly / Quarterly Installments | Women, Youth, Disabled, Widows |

| Household Support Loan | Up to 100,000 | 0% (Interest-Free) | Flexible | Poor Families, BISP Beneficiaries |

Benefits of Khud Mukhtar Program 2025 Loan

The Khud Mukhtar Program 2025 Get Loan up to 1.5 Lakh offers several benefits for Pakistani citizens:

- Financial independence: People can start their own small business.

- No burden of interest: Loans are completely interest-free.

- Women empowerment: Women are given priority to make them self-reliant.

- Youth support: Young people can invest in new opportunities.

- Poverty reduction: Families move from dependency to self-sufficiency.

Common Problems People May Face

Like any government program, applicants may face some challenges:

- Delays in loan approval due to high number of applications.

- Biometric verification issues for women or elderly applicants.

- Incomplete documents causing rejection of application.

- Lack of awareness about repayment schedules.

The best way to avoid these issues is to keep all documents ready, use your own registered mobile number, and ask for guidance at the BISP office.

Conclusion

The Khud Mukhtar Program 2025 Get Loan up to 1.5 Lakh is a golden opportunity for poor and low-income families in Pakistan. By offering interest-free loans, the government is encouraging people to stand on their own feet instead of relying only on aid. If you are struggling to manage your household or want to start a small business, this is your chance. Make sure you visit the nearest BISP office, complete the application process, and take full advantage of this initiative.

FAQs

Is the Khud Mukhtar Program 2025 loan really interest-free?

Yes, the loan is completely interest-free. You only have to return the principal amount in installments.

Can men also apply for this loan?

Yes, but priority is given to women, widows, and disabled persons. However, low-income men can also apply if eligible.

How long does it take to get the loan after applying?

It usually takes 15 to 30 days, depending on verification and document checking.

What if I cannot return the loan on time?

The repayment schedule is flexible. You can request an extension at the office, but it is important to repay on time to keep your record clean.

Disclaimer

⚠️ Disclaimer: This article is for informational purposes only. We are not affiliated with any government agency. For official updates, visit the official BISP website.

Note: This content is based on publicly available information. We are not affiliated with BISP or any government body. Read full disclaimer here.