BISP Payment Withdrawal System

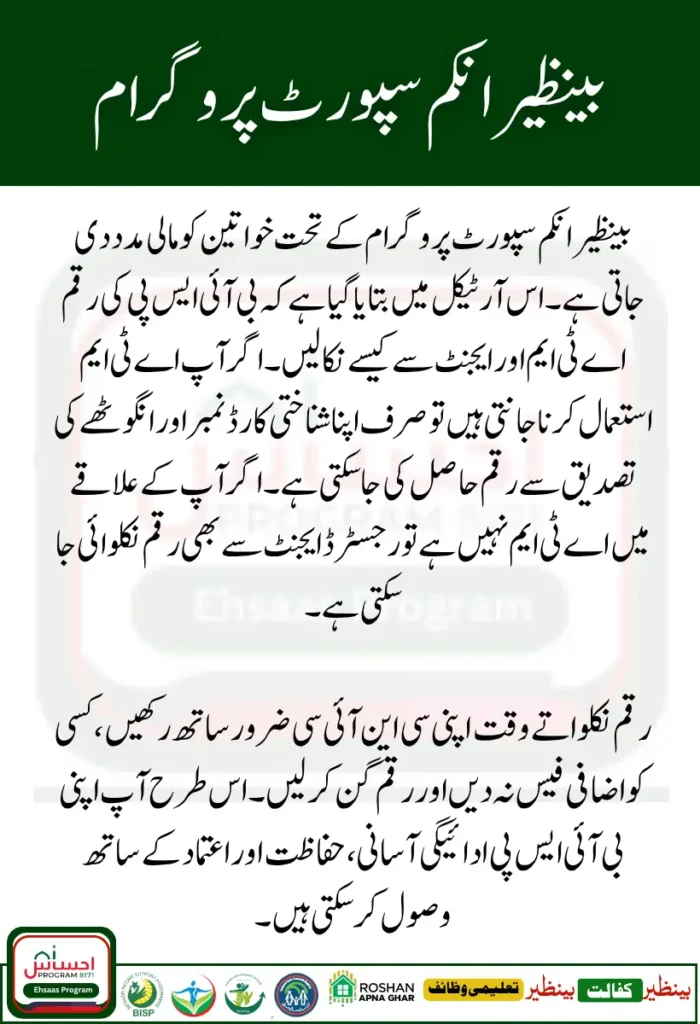

BISP Money from ATM has been a lifeline for millions of families across Pakistan. It provides financial assistance to women and low-income households who need help meeting their daily needs. After registration and eligibility confirmation, the next step is knowing how to withdraw BISP money from ATM and agent safely and correctly.

Over the years, the government has made several improvements in the BISP payment system. In the beginning, payments were only made through cash centers or specific agents. But now, beneficiaries can withdraw their money easily from ATMs as well as from registered agents in their area. This system ensures convenience, transparency, and security.

You Can Also Read : Increased Education Stipend for Girls in Govt Schools 2025 Update

How to Withdraw BISP Money from ATM Step-by-Step Process

One of the most convenient and secure ways to get your BISP payment is through an ATM. You don’t need any ATM card your CNIC and thumb verification are enough. Here’s a simple and clear explanation of how to withdraw BISP money from ATM:

Step 1: Find the Nearest Partner Bank ATM

Currently, BISP works with several banks in Pakistan, including HBL, Bank Alfalah, and others. Visit the ATM of a partner bank near you.

Step 2: Choose the BISP or Ehsaas Option

When you reach the ATM, press the “BISP” or “Ehsaas Kafalat” button displayed on the screen.

Step 3: Enter Your CNIC Number

You’ll be asked to type your CNIC number on the screen. Make sure you enter it correctly.

Step 4: Thumb Verification

Next, place your thumb on the biometric device attached to the ATM. This is to confirm your identity.

Step 5: Check Your Balance or Withdraw Cash

Once your verification is successful, you’ll have two options — check your balance or withdraw your BISP money. Choose the withdrawal option.

Step 6: Collect Your Cash and Receipt

The ATM will dispense your cash and a printed receipt showing your remaining balance. Always keep the receipt for record purposes.

This is the complete and safe method of how to withdraw BISP money from ATM without paying anyone.

You Can Also Read : Easy Guide to Verify Your 8171 Payment Online

ATM vs Agent Withdrawal – Comparison

| Feature | ATM Withdrawal | Agent Withdrawal |

| Verification | Thumb on biometric scanner | Thumb on agent’s device |

| Required Documents | Original CNIC | Original CNIC |

| Charges | Free (no deduction) | Free – Beware of fake deductions |

| Availability | 24/7 at ATM machines | During office hours only |

| Best For | Women who prefer privacy and independence | Those without access to ATMs |

How to Withdraw BISP Money from Agent (Cash Center Method)

If you don’t have an ATM near your area, don’t worry you can still get your money from a registered BISP agent or cash center. This process is also safe if you follow the correct steps. Here’s how to withdraw BISP money from an agent:

Step 1: Visit the Nearest BISP Agent or Payment Point

These agents are authorized by the government and are usually located in tehsil offices or local shops.

Step 2: Carry Your Original CNIC

Always bring your CNIC for verification. The agent will not release payment without confirming your identity.

Step 3: Thumb Verification on the Biometric Device

The agent will ask you to place your thumb on their biometric machine. If your thumbprint matches, your payment process will start.

Step 4: Receive Your Payment

After verification, the agent will hand you your BISP money in cash. Count it before leaving to ensure the amount is correct.

Step 5: Get a Printed or Written Receipt

Ask for a payment slip or written confirmation from the agent for your records.

This is the official method for how to withdraw BISP money from agent safely and directly.

Documents Required for BISP Payment Withdrawal

Before going to an ATM or agent, make sure you have the following documents and information ready:

- Original CNIC (Computerized National Identity Card)

- CNIC copy (for backup)

- Registered mobile number (optional but useful)

- Knowledge of your BISP ID or reference number (if available)

Having these items ready makes your BISP money withdrawal faster and smoother.

You Can Also Read : 8171 Verification Problem Resolved

Common Issues During BISP Money Withdrawal and Solutions

Many people face small technical or fingerprint-related problems during the withdrawal process. Here are some common issues and their solutions:

- Thumbprint Not Matching: Wash your hands and try again. If still not working, visit another ATM or agent.

- ATM Out of Cash: Try a different bank’s ATM or visit an agent.

- Payment Not Showing: Sometimes, payments are delayed by a few hours. Check again later or confirm with your BISP office.

- Agent Asking for Extra Charges: Never pay any extra fee. Report such cases to the nearest BISP center.

You Can Also Read : How to Calculate Monthly Repayment for an E Bike

Safety Tips While Withdrawing BISP Money

BISP beneficiaries, especially women, should follow these safety tips to avoid fraud or loss:

- Don’t share your CNIC or payment information with strangers.

- Always withdraw money in daylight and from trusted locations.

- Count your cash immediately after receiving it.

- Avoid giving your thumbprint more than once at an agent’s shop.

- Keep your CNIC and payment receipts safe.

Why Biometric Verification Is Important in BISP

The biometric verification system ensures that only genuine beneficiaries receive payments. Every transaction, whether from ATM or agent, requires thumb verification linked to NADRA records. This prevents fraud and ensures transparency.

If your fingerprint doesn’t match repeatedly, you can visit your local BISP office to update your biometric data. It’s part of the secure system designed to make BISP money withdrawal safe and reliable for everyone.

Benefits of Knowing Both Withdrawal Methods

Understanding how to withdraw BISP money from ATM and agent gives you several advantages:

- You don’t have to depend on one method.

- You can switch between ATM or agent based on availability.

- It saves time and avoids long queues.

- You gain confidence using modern banking systems.

- You reduce the risk of fraud by knowing the correct procedure.

Conclusion

Learning how to withdraw BISP money from ATM and agent is an essential step for every beneficiary. Whether you choose the ATM method or the agent option, make sure to follow the official procedure and protect yourself from fraud. Always use your own CNIC, never share your PIN or thumbprint with others, and count your money before leaving the ATM or shop.

By understanding the system, you can receive your funds without stress and make the best use of this government support for your household’s needs. Stay informed, stay alert, and help others in your community learn this process too.

You Cna Also Read ; BISP New District List

FAQs

Can I withdraw my BISP payment without CNIC?

No, your original CNIC is mandatory for both ATM and agent withdrawal.

What if my thumbprint does not match at the ATM or agent?

Try again after cleaning your hands, or visit another location. If it continues, go to the BISP office for biometric update.

Are agents allowed to charge any fee for withdrawal?

No, all withdrawals are free. If anyone demands money, report them immediately.

Can I check my remaining BISP balance after withdrawal?

Yes, you can check your remaining balance using the same ATM after collecting your payment.

Disclaimer

⚠️ Disclaimer: This article is for informational purposes only. We are not affiliated with any government agency. For official updates, visit the official BISP website.

Note: This content is based on publicly available information. We are not affiliated with BISP or any government body. Read full disclaimer here.